The Paris prosecutor said Saturday two new suspects were handed preliminary charges for their alleged involvement in the crown jewels heist at the Louvre museum, three days after they were arrested by police as part of the sweeping investigation. Laure …

Author: Admin

Markets/Coverages: AXA XL Offers Cyber Solution for Europe, APAC Construction Firms

AXA XL announced the launch of a new cyber solution designed to provide construction firms in Europe, Asia and Australia with enhanced protection against the rapidly evolving landscape of cyber threats. Available by endorsement to AXA XL’s cyber insurance coverage, …

People Moves: H.W. Kaufman Group Promotes 16 Across Executive and North American Teams; Howden US Names Dallal EVP, Financial Lines

H.W. Kaufman Group Makes Promotions Across Executive and North American Teams H.W. Kaufman Group, headquartered in Farmington Hills, Michigan, promoted 16 members of its executive and North American teams to new roles. The announcement follows the 2025 Kaufman Leadership Meeting …

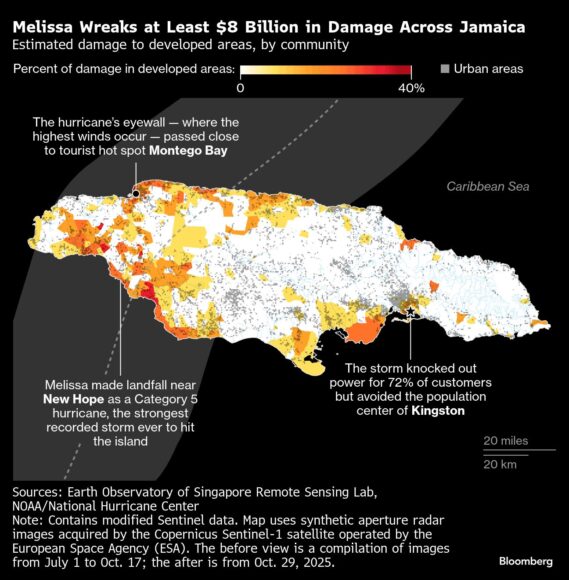

Jamaica Catastrophe Bond Has Now Triggered, Government Says

Jamaica’s catastrophe bond has now triggered as a result of the fallout from Hurricane Melissa, the government said. “Over the next few weeks we’ll get more details into what the payout is,” Dana Morris Dixon, minister of education, skills, youth …

A Toy Maker Takes His Case Against Trump’s Tariffs to the Supreme Court

Within days of Donald Trump announcing his sweeping “Liberation Day” tariffs in April, Rick Woldenberg was looking for a law firm to help him sue the U.S. president. “I’m not willing to allow politicians to destroy what we have built …

Buffett’s Berkshire Cash Hits $382 Billion, Earnings Soar

Berkshire Hathaway Inc.’s cash pile soared to $381.7 billion in the third quarter, a fresh record, and operating earnings surged 34% at Chief Executive Officer Warren Buffett’s conglomerate. That figure hit $13.5 billion, as the firm’s insurance underwriting profit more …

Black Vultures Spreading North, Attacking and Killing Cattle

Allan Bryant scans the sky as he watches over a minutes-old calf huddled under a tree line with its mother. After a few failed tries, the calf stands on wobbly legs for the first time, looking to nurse. Above, a …

Don’t Look Now, But Citizens Is No Longer the Largest Property Insurer in Florida

Citizens Property Insurance Corp., the state-created insurer of last resort, is no longer the largest carrier in Florida. The ranking is seen as a significant milestone in the push for a more stable, market-based insurance market. Citizens’ leadership announced late …

Judge Dismisses Texas Challenge to New York Abortion Shield Law

A New York judge dismissed a legal challenge Friday from Texas seeking to enforce a more than $100,000 civil judgment against a doctor accused of prescribing abortion pills to a Dallas-area woman in an early test of the state’s “shield …

‘I Thought I Had Died,’ Testifies Teacher Shot by 6-Year-Old Student

A former Virginia teacher who was shot by a 6-year-old student in her classroom in 2023 testified Thursday that she thought she had died that day. Abby Zwerner testified in her $40 million lawsuit filed against a former assistant principal …