Alabama has become the seventh state to adopt the “SLIP+ for States” reporting and payment platform for surplus lines data and taxes, starting in 2025. Surplus lines brokers who already have a SLIP+ login do not need to register for …

Author: Admin

Suspects in Louvre Heist in Custody After Week-Long Manhunt

French authorities have arrested several suspects after a frantic manhunt for the men who staged a spectacular daytime heist at the Louvre museum that gripped the world and embarrassed the government in Paris. The Paris prosecutor’s office confirmed the arrests …

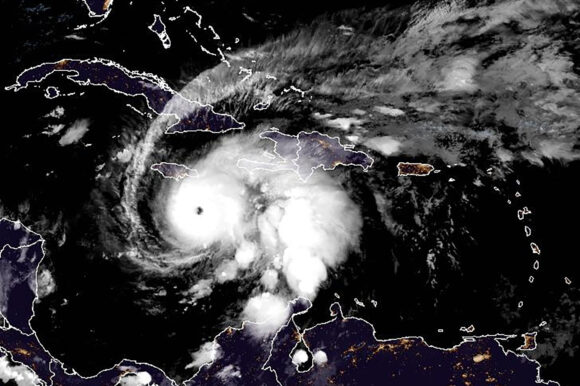

Update: Hurricane Melissa Churns Toward Jamaica as Category 5 Storm

Hurricane Melissa plowed toward Jamaica as a powerful Category 5 storm, threatening to bring widespread destruction to the island. Melissa’s top winds reached 160 miles (257 kilometers) per hour, the US National Hurricane Center said in an advisory at 8 …

HSBC to Take $1.1 Billion Hit After Luxembourg Court Ruling in Madoff Case

HSBC Holdings said on Monday it would book a $1.1 billion provision in its third-quarter results after losing part of an appeal in a long-running lawsuit tied to Bernard Madoff’s Ponzi scheme, history’s biggest ever such fraud. HSBC acted as …

HK Startup Aims to Launch Satellites for 3D Wind Data, SCMP Says

Hong Kong startup Stellerus aims to create a constellation of satellites to become the world’s first provider of three-dimensional wind data provided by the devices, according to the South China Morning Post. Stellerus, founded in 2023 by Hong Kong University …

AM Best Revises Outlooks to Stable for Members of Illinois’ Pekin Insurance Group

AM Best has revised the outlooks to stable from negative and affirmed the Financial Strength Rating (FSR) of A- (Excellent) and the Long-Term Issuer Credit Ratings (Long-Term ICR) of “a-” (Excellent) of The Farmers Automobile Insurance Association, its wholly owned …

Hacking Lab Boss Charged With Seeking to Sell Secrets

A director at a company that sells computer vulnerabilities has been charged with stealing secrets to sell to an unspecified buyer in Russia, according to a court document and people familiar with the matter. Peter Williams was accused of stealing …

Consumers Seek $2.36B From Google After Privacy Verdict

U.S. Google users who won a $425 million jury verdict in a consumer privacy class action last month have asked a federal judge to force the Alphabet unit to forfeit an additional $2.36 billion in profits. The consumers in an …

Florida’s Universal P&C Reports Strong Profits, Policy Growth for Q3

Universal Insurance Holdings, parent company of Florida’s third-largest property insurer, reported an improved bottom line for the third quarter this year, even with a steady increase in policies in recent months. After shedding more than 160,000 policies in the turbulent …

Plan to Sell Golf Course Built on Slave Graves Sparks Outrage in Florida’s Capital City

A dark history long buried under the towering live oak trees and manicured lawns of a country club in Florida’s capital city of Tallahassee is reviving painful memories of the community’s segregated past and fueling some residents’ calls for a …