Tesla’s proposed $1 trillion pay package for CEO Elon Musk came under fresh scrutiny on Friday, with proxy adviser ISS urging shareholders to reject what might be the largest-ever compensation plan awarded to a company chief. This is the second …

Author: Admin

LA County Reaches New $828 Million Deal With Abuse Victims

Los Angeles County reached a tentative agreement to pay an additional $828 million to victims of childhood sexual abuse who filed lawsuits under a 2019 state law that raised the statute of limitations for such cases. The settlement addresses 400 …

People Moves: Physicians Insurance A Mutual Company Names Carlson President, CEO

Physicians Insurance A Mutual Company appointed David Carlson as president and CEO. The PI appointment is effective November 1. Dr. Carlson succeeds William Cotter, who is retiring from the organization after a 35-year career. Carlson is a physician executive with …

Bringing People and Artificial Intelligence Together to Mitigate Risk

Artificial Intelligence (AI) is a valuable resource in today’s economy with the potential to reap great rewards in many avenues of business. However, as with any developing technology, it comes with new challenges. In a recent study by The Hartford, …

Tips to Make the Most of Carrier Relationships

I remember talking with an agency owner a few years ago who had gotten upset with an insurance carrier with whom they were working. This has been a frequent occurrence in the last few years as the hard market has …

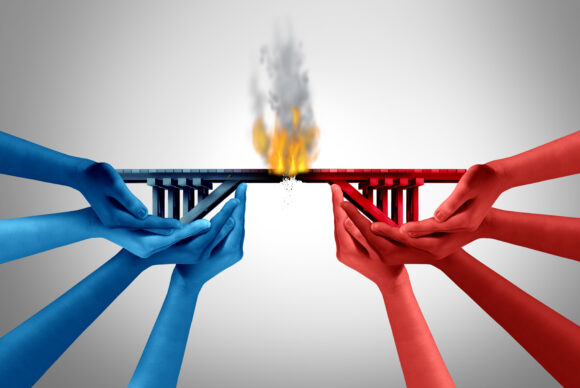

Gallagher Sues Two Former Brokers Who Started Their Own Firm

Global insurance broker Arthur J. Gallagher is suing two former employees who left to start their own New York brokerage firm for allegedly soliciting Gallagher clients and using confidential information in violation of their employment agreements. Gallagher claims that James …

Agent Has No Duty to Tell Insured of Pending Nonrenewal: Connecticut High Court

A Connecticut insurance agent has no duty to inform clients that their home insurer intends not to renew their insurance policy, the state’s high court affirmed in a case where the homeowners argued their long relationship with the agent created …

Study Shows California Heat Standard Reduced Work Injuries on Hot Days

California’s worker heat standards led to fewer work-related injuries on hot days, a new study from the Workers Compensation Research Institute found. The WCRI study, Impact of California’s Heat Standard on Workers’ Compensation Outcomes, measured how California’s heat standard impacted …

California Police Pulled Over A Waymo for An Illegal U-Turn, But They Couldn’t Cite

Police in Northern California were understandably perplexed when they pulled over a Waymo taxi after it made an illegal U-turn, only to find no driver behind the wheel and therefore, no one to ticket. The San Bruno Police Department wrote …

J&J Must Pay $966M After Jury Finds Company Liable in Talc Cancer Case

A Los Angeles jury ordered Johnson & Johnson to pay $966 million to the family of a woman who died from mesothelioma, finding the company liable in the latest lawsuit alleging its baby powder products cause cancer. The family of …